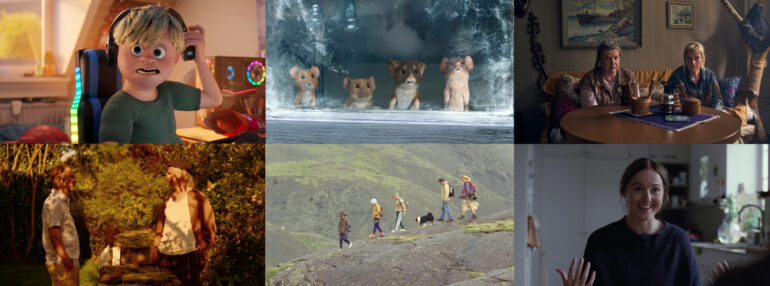

Nordic distributors take stock as autumn brings a flood of festivals and releases

Amid shrinking windows, rising costs and changing viewing habits, the region’s distributors are re-defining what independence means — and how to keep cinema alive across small yet fiercely individual markets.