WRITTEN BY: Ninna Bengtsson

The creator economy took centre stage as platforms like YouTube and TikTok are now being embraced by the industry as valuable new partners – and everyone wants a piece of the action.

YouTube has come in from the cold. Never before has the video platform, which is celebrating its 20th anniversary, had such a presence at the Palais des Festivals during MIPCOM. Hardly surprising, given that it’s the younger audiences everyone in the industry – from broadcasters and public service channels to production companies and advertisers – is chasing. And those audiences are overwhelmingly on social media and video platforms.

The creator economy took centre stage as influencers and heads of digital studios dominated the conversations and stole the spotlight. Lucy Smith, Director of MIPCOM Cannes and MIP London, summed it up:

“This has been the biggest change in a generation for MIPCOM. We’ve brought the Creator Economy into the heart of the market, and we’ve welcomed YouTube for their first major presence.”

Giants like ITV, Banijay, Fremantle, BBC Studios, and others were in Cannes, and collaborations was a common topic. BBC Studios’ SVP of Digital Jasmine Dawson participated in a packed session together with Pedro Pina, VP and head of YouTube EMEA. Dawson praised the BBC Earth channel on YouTube, which now boasts over 14 million subscribers.

“Every single content producer and content creator has a role, a space on Youtube. The reason we are here is to reach out to everyone,” said Pedro Pina.

Today, most major broadcasters, studios, and TV channels have a presence on the platform. When it comes to children’s programming, YouTube viewing is surging among kids aged 4 to 15 – particularly in the UK, according to Glance. At the same time, 5 out of 10 YouTube channels for kids in key European markets are based on established TV IP.

And for other types of content, the interest is also rocket high. Recently, SF Studios made several Swedish film classics available on a dedicated YouTube channel. Public broadcaster SVT is also following the development, and plans to “review its strategy in this area”, according to its press office.

Has YouTube come in from the cold?

“We are meeting with virtually every media company right now, SVT and TV4 in Sweden, and TV 2 in Denmark, and all of them already have a presence on YouTube. We are working together on how they can evolve, reach younger audiences, and ultimately drive viewers back to their own streaming services. They have the brands and amazing content, and we have the reach and scale. That partnership is strengthening and growing,” said Michelle Kadir, YouTube’s Head of Northern Europe.

The content coming from Scandinavia is popular. For instance, around 70 per cent of what is being produced on YouTube in Sweden, is consumed internationally, according to the company.

“Creators in the Nordics are particularly strong at experimenting with formats and collaborating with production companies to bring their ideas to life. Many have evolved their channels into businesses, becoming their own production companies and building their own studios.”

Michelle Kadir also pointed out that one of the advantages of video platforms is the instant audience feedback.

“I have colleagues in Turkey who tell me that several Turkish production companies now test their pilots on YouTube first. That’s where you start when launching a new idea, and then you will see how it is performing.”

Former rivals are becoming partners in the battle for advertising revenue and audience attention. According to several companies that Nordisk Film & TV Fond talked to, collaboration and partnership are the new currencies. In a world where half of all streaming hours in the U.S. go to Netflix and YouTube, the rest of the industry wants a piece of the action.

"I don't think it's either/or anymore. YouTube is not going to make everything we do, and turn us all into dinosaurs, I think it's something we can combine. It's also down to what types of genres or shows we are talking about. There are more natural connections between the unscripted content and the YouTubers," said Johannes Jensen, Head of Scripted, Business, at production company Banijay Entertainment to NFTVF:

“For instance, with young adult series, we should definitely be able to do them in different formats, like the vertical drama or drama for smaller screens. Younger viewers are on these platforms, and that's where we should be too. But we need to figure out how to fund it. What YouTubers and others have managed is to get the audience’s attention, and we want to tap into that.”

Johannes Jensen pointed out that there will always be a demand for well-made drama.

“There is still a great business doing high quality drama, that hasn’t changed. But we need to be agile, fast-footed, and ask: ‘Okay, if that's a trend, how can we use it with what we are currently doing?’”

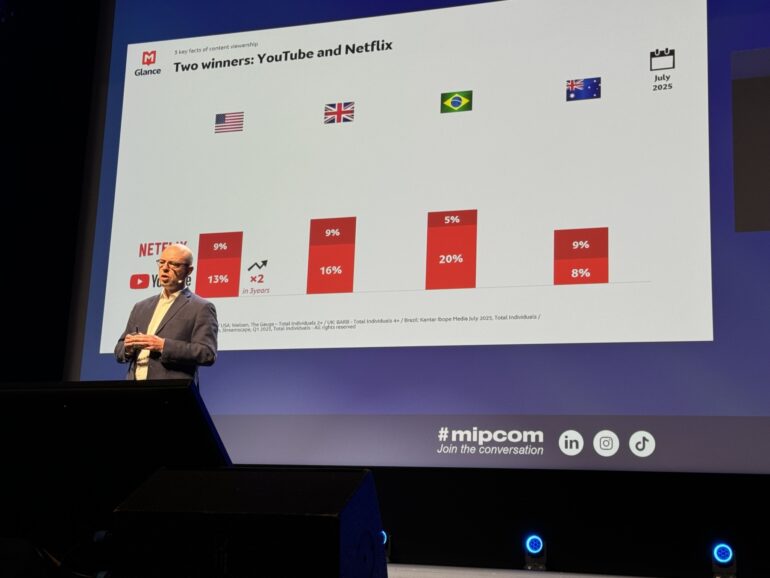

It is an industry in transition, where old structures are breaking down. Frédric Vaulpré, SVP of the French analytical company Glance, called it “a world of hyper-distribution”.

“Many TV companies are creating their own digital BVOD services, they all want to capture the young audience. To do that, you have to collaborate with platforms such as YouTube or Netflix. At the same time, we are seeing some resistance from private TV channels. Probably because they believe that the revenue model is not sufficiently advantageous for them, or more advantageous for the tech giants," said Vaulpré.

According to London-based analytics firm Ampere Analysis, the global market, worth $800 billion, is mainly divided into two parts – one of which is shrinking and the other one growing. Traditional broadcasters and TV-channels are finding it increasingly difficult to compete with streaming and video platforms such as YouTube, TikTok and, to some extent, social media such as Instagram and Snapchat, which are flourishing. The former often produce and distribute local high-cost professional content, while global Big Tech-companies such as YouTube and TikTok act as platforms for low-cost creator content that’s monetising through advertising.

Collaborations can benefit both parties.

”A more balanced relationship emerges, as the platform gains access to high-quality local content and the company gets its content distributed to audiences it would not otherwise have reached,” said Guy Bisson, Research Director and co-founder of Ampere Analysis.

However, he sees a problem with profitability when content is made available on YouTube and does not fully replace the loss of revenue from subscriptions and linear TV-advertising. Monetisation and the balance between the creator economy and the professional economy is something that presents quite a conundrum, if you are trying to move between those two different spheres, according to Bisson.

One solution is to post content on platforms with lower CPM (Costs Per Mille).

”Utilising lower CPM platforms purely to direct back to your own services is one solution,” said Bisson:

”You can increase the volume of advertising on YouTube content, or you can use the content you put on YouTube to funnel people back to your own service where the advertiser value is higher. Or you can partner with platforms that also have a high advertising value, like Netflix.”

Another major issue, according to Ampere Analysis, is the lack of transparency around how the algorithm actually works – and discoverability remains a challenge. YouTube’s Pedro Pina assured that search results and content rankings are driven solely by user interest. But the waters can be murky.

“Discoverability remains one of the biggest challenges in today’s digital landscape. With millions of videos uploaded to platforms like YouTube every day, standing out requires more than great content, it demands strategy,” said Ceyda Sıla Çetinkaya, COO at Merzigo, a video content distributing and monetising company with 5,000 channels on YouTube and Meta.

Çetinkaya said success depends on a data-driven approach that combines rights protection, intelligent distribution, and audience insight.

“We treat YouTube as a true broadcaster, planning weekly programming schedules, optimising for watch time, and adapting formats across multiple languages. Our proprietary technology harnesses data insights to refine every stage of the process, from editing and thumbnail design to upload timing, maximising reach, retention, and monetisation.”

But harnessing personal data comes with its own challenges. The European Commission recently fined Google three billion euros for the “abuse of online advertising technology”, and no one knows how the big tech giants will react to the European market in the future, with new directives like the AVMD and Digital Services Act.

Another sticking point is whether YouTube should be classified as a social media platform or a video platform. In both Denmark and Sweden, a national age limit of 15 years for the use of social media is currently being debated – a rule that could also end up affecting YouTube.

Guy Bisson also sees a very different film- and TV market unfolding in the future.

”We've heard a lot about YouTube, but other platforms like Spotify, streamers, even game consoles, are now increasingly becoming options for television distribution. We need a complete rethink of how everything fits together,” said Guy Bisson.